ServerWorks - Riding the J-Cloud Wave

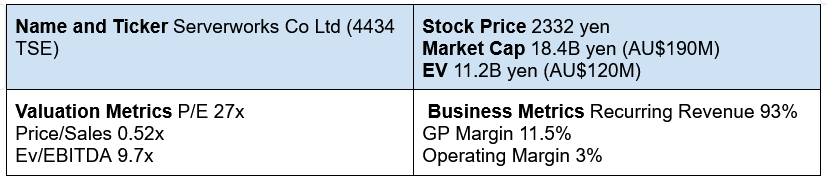

A rapidly growing cloud reseller available at a reasonable price

Shoutout to Andy The Magic Bakery’s writeup on Serverworks, I found this business through his substack. His writeup is way better than mine so it is a highly recommend read.

Executive Summary

Investment Thesis

ServerWorks is a Japanese cloud reseller for AWS and Google Cloud (GCP), offering cloud migration, resale and managed service to its clients. In Japan, cloud adoption is expected to grow at 30% per year until 2029 (Gartner estimates). ServerWorks is one of the 15 AWS Premier Tier service resellers1 (and the only listed one) with 93% of its revenues being recurring due to its ‘cloud resale’ and ‘managed cloud’ offerings.

The current market cap is 18.4B yen, however if we remove cash and investments the business trades at a P/E of 12x or an EV/EBIT of 10.4x. Moreover, it trades at an FY28 EV/EBIT of 7x based on FY28 EBIT of 1.6B yen.

Serverworks is growing rapidly; it has 4xed its revenues from FY20 to FY25 (CAGR of 39%). Furthermore, growth accelerated in FY24 and FY25 to 44% CAGR as the company started reselling GCP through its subsidiary ‘G-Gen’. The founder and CEO Ryo Oishi (age 52) holds 32% of its shares. He started this business in 2000 and began reselling AWS in 2008.

What’s the opportunity?

Japan has been 5-7 years behind the curve in cloud adoption in their business. Since COVID, Japanese companies are desperately catching up with the rest of the world to migrate legacy, on-premise information systems onto the cloud.

Plus, the percentage of IT spend on public cloud in Japan is 6% compared to 15% in the US hence there’s room for increased cloud spend.

Why Now?

While Serverworks has rapidly scaled its revenues, it has come at the cost of lower operating margins. During the FY25 results briefing, CEO Oishi-san explained that management made a conscious decision to sacrifice margins in the short term to expand the team and hire from the scarce pool of technology workers who have expertise in cloud. Management has indicated that operating margins will remain at current levels until FY28.

The stock market has not responded kindly2 - the P/E ratio has dropped significantly and the share price has almost halved as Mr. Market lost patience.

Serverworks has multiple growth levers, including - resell cloud to new customers, cater to the increasing cloud workload needs of existing clients, expand operating margins, and expand ARPUs (Refer Growth Runway section for details).

Serverworks’ expected profit growth of 15% CAGR over the next 3 years (per management estimates) plus the current earnings yield of 3% should translate into a decent 18% annual return over the next 3 years. Additionally, margin expansion and share buybacks will be cherries on top.

Business Model

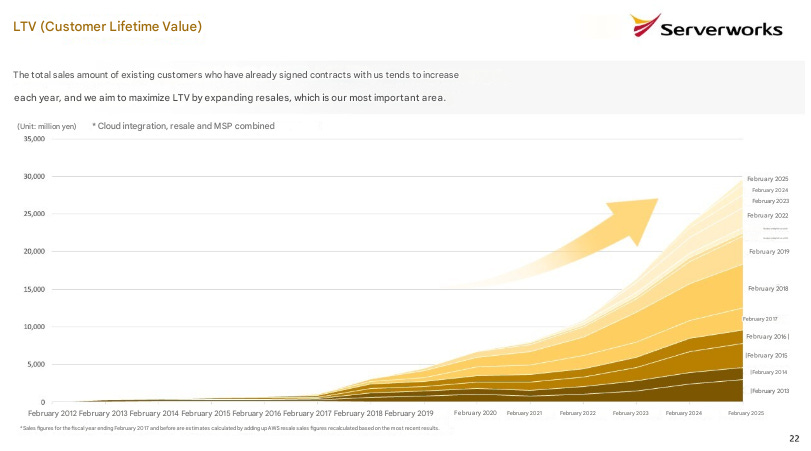

Serverworks offers three core services, one is cloud integration, i.e. planning, designing and transitioning the client’s existing on-premise information systems onto the cloud. Integrating a customer into AWS secures a revenue stream for many years because their second core service is cloud resale, where it helps clients with billing, backups, optimising cloud usage, etc. Typically, Serverworks profits from the difference between the wholesale AWS price and the prices charged to its 1270+ company clients.

Their third core service is managed cloud service where it monitors the performance of systems configured on AWS, conducts failure monitoring, and offers operation services, such as a recovery service in the event of failure. Through standardization, it helps clients to reduce their AWS operating costs.

The above chart shows how existing clients have continued to work with and increased their billings with Serverworks.

Serverworks has also developed an in-house SaaS solution called ‘Cloud Automator’ which helps clients to improve the quality of AWS operations by automating and optimizing operations. Features include (1) providing services such as backups, EC2 (virtual servers), and RDS (relay servers) (2) Job automation function for starting and stopping the cloud-based database (3) Automated configuration review function to check whether the system is being used (4) Job Execution Schedule feature to check scheduled job executions in a list.

Cloud Automator3 has 4,000 users and has helped companies reduce their AWS costs by 30-40%. Gartner reports that organizations typically spend 70% more than their initial cloud budget, hence saving operating costs is a powerful value-add for its clients.

The flipside of saving costs for clients is that Serverworks’ billing is reduced in the short run, but it enables stickiness as clients want to keep working with them in the future..

Serverworks also allows its Japanese customers to pay in yen by invoice and offers flexible, department-specific billing—a service that is not provided by AWS directly,

Why Do Clients Need a Reseller?

Do clients really need a middleman? They could go directly to AWS to migrate their on-premise systems onto the cloud. However, they wouldn't get the personalised attention, guidance, advice and support that clients need since AWS is catering to hundreds of thousands of clients. Similarly AWS does not have the bandwidth to directly support the client to (1) optimise their AWS usage and costs (2) manage their backups (3) customise their billing (4) help with system uptime, operation management and system recovery. That’s where the reseller adds value to the client. It also adds value to AWS, since resellers act as ‘Sales and Support’ representatives of AWS and provide bandwidth and technical expertise to clients.

Growth Runway

Management estimates profits to increase by 15% CAGR from FY25-28, mainly driven by clients adopting and implementing AWS. Thereafter, the next 5-7 year wave will come from the processing of additional workloads on the cloud. Gartner estimates that from 2023-28, the global workloads on the cloud will go from 25% to 70%, This is currently playing out in the US and other countries that are ahead in the cloud adoption journey because new technologies like Generative AI, IoT, robotics, etc. demand higher cloud usage, which would lead to higher billing and revenues for Serverworks.

In addition, management predicts that over the long term, operating margins of 4% are achievable, compared to current operating margins of 3% (as a side note, its direct competitor Classmethod’s operating margins are 8.4%). This 1% increase could add 560M yen to the bottomline which is a 35% increase to the FY28 EBIT estimates.

Another lever for growth is increasing the ARPU across its 5,706 users. Management has consciously decided to keep ARPUs flat since Q4 FY2023 at US$18,000-19,000 per user per quarter. However in the future, management could increase pricing to meaningfully add to the bottom-line.

Competition

AWS v. the Rest

Why has AWS managed to corner a 30% market share not just in the US but across major markets? The obvious one was that AWS was a first mover, which gave it a significant head start of 4-5 years before Microsoft and GCP became commercially available in the US. Similarly in Japan, AWS had a 3-year head start over Microsoft and a 5-year head start over GCP.

But there are also other factors such as:

Low Latency: AWS operates in 117 Availability Zones across 37 geographic regions, providing the most extensive global infrastructure of any cloud provider, which ensures high availability and low latency regardless of customer location.

Purpose-built Chips - AWS has designed custom-built processors that enable lower costs and higher throughput for general as well as AI workloads

Pricing: In typical Amazon fashion, AWS has lowered its price more than 70+ times over the last decade. AWS also offers volume-based discounts and also offers reduced rates on reserved compute capacity (called reserved instances) compared to on-demand instances.

AWS Reseller Competitors

The majority of Japanese enterprises subscribe to cloud resellers rather than go to AWS, Azure, and GCP directly. Cloud reseller dependence increased from 43% in 2017 to 60.6% in 2022, and it is trending upward. This is positive for Serverworks.

There are more than 500 AWS resellers in Japan, but only 15 of them (including Serverworks) are Premier tier. No other reseller is listed on the stock market, which is an advantage for Serverworks since being a listed company offers a level of credibility and exposure.

Serverworks and Classmethod are the two largest independent AWS resellers in Japan. Classmethod is a larger player (revenues of 77B yen v. 35B yen for Serverworks) and has a broader product offering – Cloudflare, Snowflake, Alteryx, in addition to AWS and GCP - which means they can easily support clients’ multi-cloud needs. It has offices in 5 overseas locations in Asia and Europe. Sales have grown at 37% from FY20-FY24 (v. 41% for Serverworks) and the company has generated high single digit operating margins.

There used to be a third competitor called Iret which was taken over by KDDI to strengthen KDDI’s cloud offering. There are also big players like Softbank, NTT and Fujitsu who are AWS partners, but they have competing interests with their own data center offering. The rest of the market is fragmented among system integrators and conglomerate affiliates.

Capital Allocation

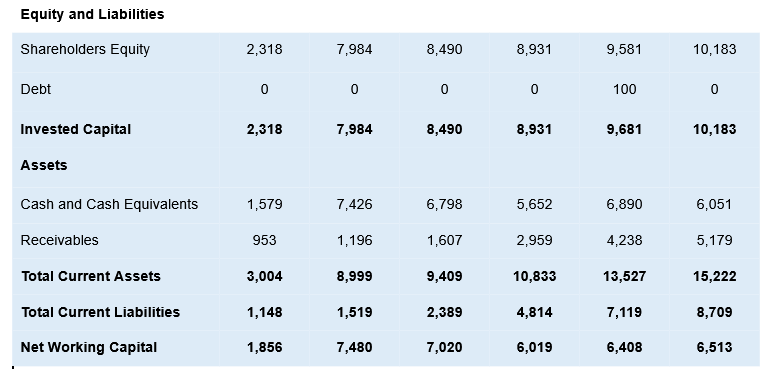

Serverworks raised 6.6B yen from FY20-FY25, mainly through the FY21 IPO which has been deployed in investments in subsidiaries and associates 3.2B yen (e.g. G-gen), and in capex 460M yen. As at Feb 2025 Serverworks has 6B yen in cash and 590M in bonds which shows that it doesn’t need a lot of capital to keep growing.

The latest mid-term management plan4 promises sharper capital allocation - i.e. reducing cross-shareholdings and focusing on shareholder returns via dividends and buybacks.

Consequently, the board authorised a buyback of 500M yen to acquire ~3% of the outstanding shares which was completed in May 2025.

Management also wants to grow via M&A and overseas expansion - I am skeptical because I think Serverworks has plenty of ground to conquer in Japan and will do well by just riding the multi-year J-Cloud wave.

Key Risks

Increased competition is a concern, since Serverworks relies on a narrow moat. A client can switch resellers or go direct with AWS

AWS losing market share would have a direct impact on Serverworks.

Japan has a chronic shortage of technology workers, hence high attrition or inability to hire more technology workers could directly impact its growth.

Capital allocation is something to watch for - management also wants to grow via M&A and overseas expansion - this can be a concern, especially since management’s track record of investments in subsidiaries, JVs and associates has been sub-par so far.

Conclusion

Similar to AWS, Serverworks is a first mover and hence has a multi-year head start compared to other resellers. Serverworks needs to grab as much land as possible by being the first through the door for Japanese companies that want to move to AWS/GCP. Once it does that, the land-and-expand part should be easier. I am bullish about the company’s prospects over the next few years.

Appendix:

Additional Notes on Business Model

In recently announced changes, Serverworks said that the managed services portion of the business which was previously delivered by an associate company Sky 365 (33% stake) will now be delivered through a new subsidiary. This will potentially impact Serverworks’ margins, as the managed services business was not profitable yet.

In Apr 2023, AWS and Serverworks signed a 4-year strategic collaboration agreement (SCA) to target the creation of $215M (31B yen) of new business. This SCA has helped Serverworks grow and scale their business, increase the digital skills of their employees, and continue to help to accelerate innovation for their customers.

In Mar 2025 Serverworks announced a strategic entry into Generative AI and Security, cross selling these offerings in addition to Cloud. The package will be ‘managed cloud + managed security’, which will enable companies to consolidate their corporate data and use Gen AI in their workplace in a secure environment.

Serverworks also increased its G-gen stake from 50% to 66% in May 2025, which means a bigger portion of the GCP revenue will be reported in Serverworks consolidated numbers from FY26 onwards. G-gen is not profitable yet, hence operating profits will fall, at least in the short run.

Culture and Recognition

In 2025, Serverworks won second place in the medium-sized enterprises category of the "Best Motivation Company Award 2025" provided by Link and Motivation.

G-gen won the Data Analytics Partner of the Year award from GCP.

Serverworks has a high employee rating (4.56 on Openwork), which is above most competitors

Financial Summary

Balance Sheet Summary

Serverworks has held the Premier Tier which is the highest level in the AWS Partner Network, since November 2014.

Lower profitability demoted Serverworks from the Prime section of the Tokyo Stock Exchange to the Standard section.

In June 2025 Cloud Automator was added to the AWS marketplace as an approved application, this could generate an additional recurring revenue stream going forward.

FY25-28 Medium Term Management Plan released in April 2025